|

Flow Research

is now shipping our very popular study, Volume X: The World

Market for Flowmeters, 9th Edition. We have also released the

companion study, Module A: Strategies, Industries, &

Applications. These studies cover the entire worldwide market for all the major types of flowmeters. Module A provides

tactical and strategic recommendations for suppliers in each market segment

and forecasts best areas for future growth. Both are new editions of

studies last published in April 2022..

Volume X

covers three types of flowmeters: Volume X

covers three types of flowmeters:

New-technology: Coriolis,

magnetic, ultrasonic, vortex, thermal

Conventional: differential

pressure transmitters, primary elements, positive displacement, turbine,

open channel, variable area

Emerging technology: sonar,

optical

The

all-in-one Volume X determines 2022 and 2023 market sizes

and forecasts growth through 2027 for all flowmeters used in process

environments. It makes it easy to compare market size, market shares, and

growth rates for all types of flowmeters. We use a bottom-up method to

determine market size for each flowmeter type, and then put these numbers

together for the worldwide picture. We believe this is the only way to get

a reliable picture of the world flowmeter market and to find out how the

different flowmeter types compare with each other. Volume X features:

-

Market size of the worldwide markets for 11

flowmeter technologies

-

Market size forecasts for each flowmeter type

through 2027

-

Market shares for each flowmeter type

-

Worldwide and regional market size and market

share data

-

A technology description and analysis for each

flowmeter type, including major

competitive strengths and weaknesses

-

Growth factors for each flowmeter technology

-

Company profiles with product information for

easy comparison

Module A covers

Coriolis, magnetic, ultrasonic, vortex, thermal,

differential pressure transmitters, primary elements, positive

displacement, and turbine flowmeters. It provides data about industry

trends and how they are impacting the flowmeter market.

We determined

the largest and fastest-growing industries and applications for each

flowmeter type and forecast the best areas for future growth. We present

the data by each flowmeter type, showing shipments in dollars and

percentages for a long list of industries and applications worldwide

and by region. Module A also includes detailed information

on the major process industries and the applications using flowmeters

today. Module A features:

-

Shipments by industry and application in

dollars and percentages, broken out by flowmeter type

-

Forecasted growth rates by both application

and industry through 2027

-

Essential information on market outlook and

industry trends by flowmeter type

-

Realistic strategies for success for those

entering or already in the flowmeter market

With a base

year of 2022 and reliable data for 2023, we forecast the market by technology to 2027. Flow Research

has definitive data on the flowmeter market going back to 1993. The first

worldwide flowmeter study was published in September 1994 and at that time

the worldwide flowmeter market was just $2.1 billion. Since that time, we

have followed the flowmeter market year by year, beginning with the first

Edition of Volume X published in February 2003. Through eight editions of

Volume X and dozens of studies on individual flowmeter types, we have

chronicled the market as it grew to over three times 1993. Our approach is to

look at each flowmeter type individually and then put all the flowmeter

types together into a definitive analysis of the entire flowmeter market.

This is also the approach we are took in the 9th Edition.

Volume X and

Module A write the definitive story of the effect of the pandemic on the

flowmeter markets. They include 2022 data as a reference point, but

also include actual data and segmentation from 2023 to show what the impact

of the pandemic was on those markets and on the oil & gas industry.

Companies were also asked to project their sales in 2024, and these

responses are taken into account in the forecasting. Forecasts are included

to 2024 that take into account the strong recovery that is already

occurring in the flowmeter markets, and in the economy as a whole. Pent-up

demand helped make 2022 a stronger year for the flowmeter markets, for the

oil & gas industry, and for the economy as a whole. This trend

continued in 2023.

Volume X and Module A display in one glance a comparison

of the revenues, units sold, and compound annual growth rate for all

the main types of flowmeters. Growth factors and limiting factors for

each flowmeter type explain the rationale of the market forecasts and what

can be expected over the next five years. No other studies exist

that provide this type of all-in-one view of the flowmeter market.

The data in

both studies is valuable for any company concerned with developing

strategies and products.. Even companies that sell only one or two types of

flowmeters can benefit from learning about the eight or nine other types of

flowmeters they are competing against.

In our 8th

Edition, we focused on the years 2019, 2020, and 2021. By looking at all

three years we were able to determine the effect of the covid-19 pandemic

for each flowmeter type. In the 9th Edition, we have a base year of 2022

and reliable data for 2023,

and have determined how the market is recovering from the pandemic. In the

9th Edition, we take a completely fresh look at the market for each

flowmeter type, and build this into a definitive picture of the entire

flowmeter market, worldwide and by region.

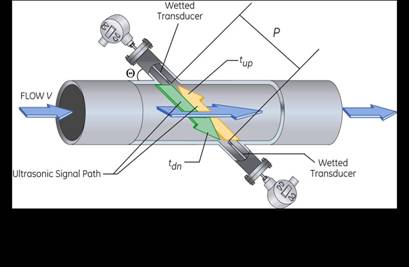

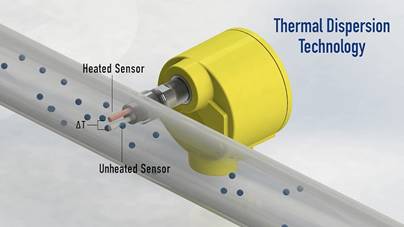

New-technology flowmeters

Most of the

new-technology flowmeters, came into industrial use in the 1960s and 1970s,

while the history of differential pressure flowmeters goes back to the

early 1900s. Each new-technology flowmeter is based on a different

physical principle and represents a unique approach to flow measurement. Magnetic

flowmeters were first introduced in Holland in 1952. Tokimec first

introduced ultrasonic meters in Japan in 1963. Eastech brought out vortex

flowmeters in 1969, while Coriolis meters came onto the market in 1977.

Thermal flowmeters were developed in the mid-1970s.

New-technology

flowmeters share several characteristics: New-technology

flowmeters share several characteristics:

1. Introduced after 1950

2. Incorporate technological advances that avoid some of the problems

inherent in earlier flowmeters

3. More the focus of new product development efforts by the major flowmeter

suppliers than traditional technology meters

4. Higher performance level, including criteria such as accuracy, than that

of traditional technology meters

5. Have

limited to no moving parts

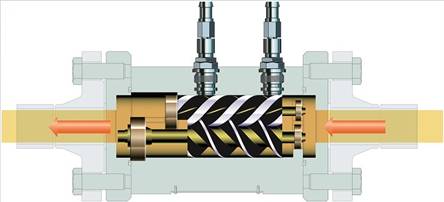

Conventional flowmeters

Many of the

conventional flowmeters were developed 100 years or more ago. In fact, the

history of DP meters goes back to the early 1900s, while the beginnings of

the turbine meter go back to at least the late 1700s.

Conventional

flowmeters include differential pressure, turbine, positive displacement,

open channel, and variable area meters. While suppliers continue to bring out enhanced

traditional technology flowmeters, they are less the focus of new product

development than new-technology meters. They share the following

characteristics:

1. Introduced before 1950

2. Less the focus of new product development than new-technology meters

3. Lower accuracy level than new-technology flowmeters

4. Slow to incorporate advances in communication protocols such as HART,

Foundation Fieldbus, and Profibus

5.Typically have moving parts that are subject to wear

Conventional

flowmeters generally have higher maintenance requirements than

new-technology flowmeters. Many of the problems inherent in DP meters are

related to the primary elements they use to measure flow. Orifice plates,

for example, are subject to wear, and can also be knocked out of position

by impurities in the flowstream. Turbine and positive displacement meters

have moving parts that are subject to wear. The accuracy levels of open

channel and variable area meters are significantly lower than

that of new-technology flowmeters.

The battle goes on: New-technology vs. Conventional

flowmeters

One of the

most interesting developments in the flowmeter market today is the battle

between the newer flow technologies and conventional flowmeters. (Emerging technologies, sonar and optical flowmeters have begun to take some

hold on the market, although each has somewhat limited applications.)

New-technology

flowmeters, first introduced after 1950, are currently the subject of

intense product development by suppliers. The need for increased

accuracy, reliability, and managed network capabilities are causing some

users to make the switch to new-technology meters. New-technology

flowmeters, first introduced after 1950, are currently the subject of

intense product development by suppliers. The need for increased

accuracy, reliability, and managed network capabilities are causing some

users to make the switch to new-technology meters.

Yet

conventional meters -- especially DP flow, positive displacement, and

turbine meters -- have the advantage of a large installed base that is

reluctant to switch without cause. In addition, they were among the first

types of flowmeters to receive approvals from industry associations for

custody transfer applications.

When users

select flowmeters, they are faced with a variety of choices. Not only are

many technologies available, but so are many suppliers for each technology.

When ordering replacement meters, users often replace like with like,

although users sometimes replace one type of flowmeter with another type.

In other cases, users need meters for new plants or for new applications

within existing plants and can select between new-technology and

traditional technology flowmeters.

While there

is a general trend towards new-technology meters and away from conventional

meters, the rate of change varies greatly by industry and application.

Despite the

growth of new-technology flowmeters such as Coriolis and ultrasonic over

the past few years, conventional flowmeters are holding their own. Why are

customers still so loyal to these meters? While the explanations vary with

the type of meter, there are five themes that run throughout:

Familiarity. End-users like having a technology

they are familiar with and can understand. DP, positive displacement, and

turbine meters, especially, are very well known and understood

technologies. There is a comfort level among users with these technologies

that is less likely to exist with the newer technologies such as Coriolis

and vortex. If more meters need to be added in a plant, users often stick

with what they have rather than selecting a different type of meter.

Installed

base. Some flowmeters, such as DP and

positive displacement, have been around for over 100 years. Once these

meters are installed, customers find in many cases that it is easier to

replace them with meters of the same kind than to switch to another

technology. Once a technology is in place, backup parts are readily

available, any potential problems are usually known, and the path for

replacement is clear. All these are reasons to stick with an existing

technology.

Approvals by standards organizations. For example, positive

displacement and turbine flowmeters are approved by the American Water

Works Association (AWWA) in the US and the International Standards

Organization (ISO) in Europe for use in custody transfer of water. The AWWA

has approvals for both nutating disc and oscillating piston PD meters. Approvals by standards organizations. For example, positive

displacement and turbine flowmeters are approved by the American Water

Works Association (AWWA) in the US and the International Standards

Organization (ISO) in Europe for use in custody transfer of water. The AWWA

has approvals for both nutating disc and oscillating piston PD meters.

The AWWA has

published approvals for magnetic flowmeters for utility measurement of

water. As a result, magnetic flowmeters are competing with PD and turbine

meters in the water custody transfer market.

Turbine

meters are specified by approval bodies for use in custody transfer for

utility measurement in residential, commercial, and industrial

applications. These organizations include the AWWA, the American Gas

Association (AGA), and the ISO in Europe. These approvals have been in

place for many years.

Product

enhancements.. Users are

also sticking with conventional meters because suppliers are bringing

out improved products. Turbine suppliers are using material such as ceramic

to improve the life of ball bearings. Rosemount has introduced the 3051S, a

pressure transmitter with increased accuracy and stability. PD suppliers

are using enhanced manufacturing techniques to build more precision into

their PD meters. Communication protocols such as HART and Profibus are

beginning to appear on turbine and PD meters. All these changes are

resulting in improved and more reliable meters for users to choose from.

Best

solution. Another reason why users continue to

stay with the traditional technologies is that they are genuinely the best

solution for certain types of flow applications. Each type of meter has its

own set of applications in which it excels.

How we capture the entire flowmeter market at once How we capture the entire flowmeter market at once

It is very

difficult to find reliable data on the entire flowmeter market without

studying each individual technology first and then combining the data

together. Without up-close knowledge of each technology, it would be very

much like viewing a landscape from 20,000 feet. You can see the outlines of

buildings and roads, but very little detail. This may be sufficient

knowledge for some purposes, but not for in-depth understanding.

What we have

done in our popular Volume X is more like the

following: We looked at the terrain from 20,000 feet and decided we needed

a lot more detail on the towns the major flow technologies -- and how

they are linked together with highways. So we landed the plane and did

detailed studies of each of the towns. We then got back in the plane with

the reports in hand, and took another look at the entire geography.

From 20,000

feet, we can now see the broad outline of each of the 11 towns below. But

because we have studied each town individually, we also have in-depth

knowledge of each town. From above, we can also easily see the connecting

roads between all the towns. This is important, because the towns do

not exist in isolation. Anytime a customer selects one type of flowmeter,

he or she fails to select one of the other types. Not every technology can be

growing at a 6 percent rate, for example. By looking at every technology,

it is possible to identify and compare the market penetration of the

different technologies, and to understand which technologies are growing

and which are being replaced.

We draw on

our in-depth studies of each technology to update the most relevant data on

all of the flow technologies at the same time rather than trying to

somehow combine new full-scale studies that would be out of date by the

time the project was done.

Taking this

second look from 20,000 feet -- capturing the very latest high-level

information like revenue, units sold, and average selling price -- gives us

the entire picture, all at one time.

Flow Research

has been publishing Volume X studies since 2003, so we can say

with confidence that our proven approach in the sky and on the

ground -- brings you the most complete, comprehensive, and current research

possible on the world flowmeter market. Please check out our Overview and see for yourself! This

year, 2023 marks the 20th anniversary of our first edition of

this study!

Previous studies:

Volume X: The World Market for

Flowmeters, 8th Edition Published in

April 2022

Volume X: The World Market for

Flowmeters, 7th Edition Published in

May 2019

Volume X: The World Market for

Flowmeters, 6th Edition Published in January 2017

Volume X: The World Market for

Flowmeters, 5th Edition Published in August 2014

Volume X: The World Market for

Flowmeters, 4th Edition Published in 2012

Volume X: The World Market for

Flowmeters, 3rd Edition Published in October 2010

Volume X: The World Market for Flowmeters, 2nd Edition

Published in April 2008

Volume X: The World Market for Flowmeters, 1st Edition

Published in 2003

|